Heath Haussamen / NMPolitics.net

Las Cruces City Hall

While some feel misled by a tax increase that means the City of Las Cruces has collected millions of yet-to-be-allocated dollars, City Manager Robert Garza says the surplus has been part of the plan all along — and the money will be used to offset lost state revenue as promised.

Las Cruces moved more quickly than many other local governments to increase taxes after the policymakers in Santa Fe shifted tax burden from corporations to cities and counties in 2013.

That year the state approved a 15-year phase out of so-called “hold harmless” payments — funds to help cities and counties make up for revenue lost when the state stopped taxing groceries and medicine in 2005. In response, the Las Cruces City Council approved a 3/8 of 1 percent increase in the gross receipts tax (GRT).

The city doesn’t need that much money immediately to make up for the phase-out of “hold harmless” payments. But the tax increase isn’t enough to offset the lost revenue long-term, Garza said.

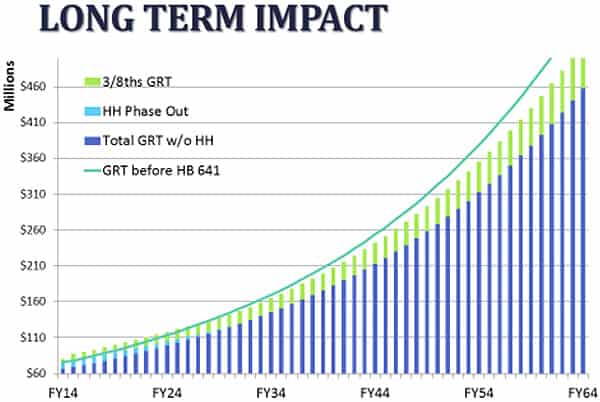

He provided the chart below to illustrate that point. The bright green line represents where city revenue would have been if the state hadn’t phased out “hold harmless” payments:

Even with the 3/8 of 1 percent GRT increase, starting in 2031 the city won’t fully recoup the lost “hold harmless” revenue — if the projections are accurate.

With the GRT increase, the city will collect approximately $68 million in extra funds over the next 15 years, according to Garza. “Between the 16th year and the 30th year, we will be losing over $12 million per year in revenues, and that amount continues to grow over time,” he said.

Thinking long-term

Why will the city lose money long-term? Garza said Las Cruces’ aging and comparatively low-income population “uses a larger and larger portion of their disposable income on food and medicine.” Not taxing groceries and medicine is why the state was providing the “hold harmless” payments it’s now phasing out. The city collects no GRT when people buy most groceries and medicine.

In addition, online shopping such as Amazon.com is “growing at an alarming rate, which will further carve GRT out of future revenues,” Garza said. That’s because people don’t pay sales tax on online shopping unless the business has a store in New Mexico — which many, including Amazon, do not.

So the city plans to use the extra money it will collect between 2014 and 2030 to “mitigate long-term lost revenues,” Garza wrote in a recent newsletter to the city council. Specifically, he wrote, the funds are to be used “exclusively for investments that will reduce or minimize future costs or generate additional revenues.”

Why not wait to impose the tax increase until the city is actually facing a deficit?

“If we waited, we would never be able to catch up, invest, or pay for projects that will reduce our costs,” Garza said. “We would not have the capacity to issue bonds later when every dollar would be needed to ‘keep the lights on.'”

What the city is doing with the money

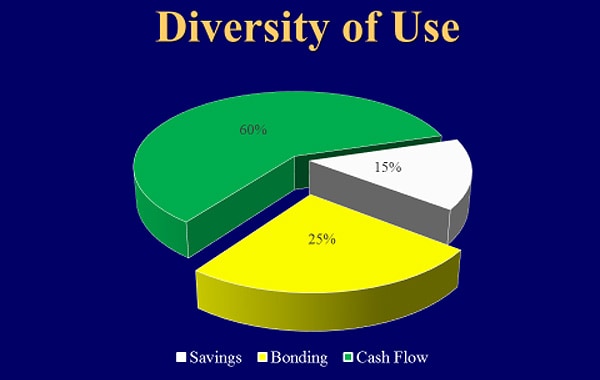

This chart provided by Garza illustrates what the city is doing with the money:

The city plans to set 15 percent of the new tax revenue aside in a savings account “that will be available in the future should the city need the funds for operations,” Garza said. Twenty-five percent will be used for bonding, “enabling us to invest sooner and take advantage of low interest rates and lower construction costs in the current market compared to projected future costs,” he said.

The city will decide annually what do to with the remaining 60 percent it gathers each year “based on an annual targeted investment,” Garza said. The city is currently looking at spending on projects including expansion of the convention center, building a sound stage to attract film and TV productions, and improvements to the airport.

In his newsletter, Garza wrote that the city plans to spend some of the money on street improvements, because overall costs are lower if needed work is done sooner. It will also spend some of the money on facility improvements focused on energy efficiency, and some on economic development.

‘Cutting costs and reducing spending’

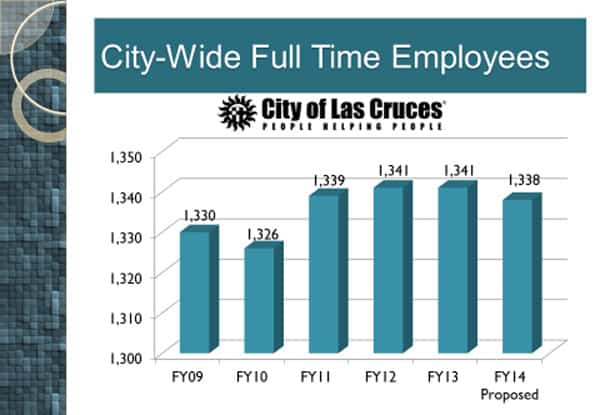

Finally, Garza wants people to know the city has been “cutting costs and reducing spending across the board.” Adjusted for inflation, the city is currently at the same spending level it was at in 2008, he said. The number of city employees has remained roughly the same for the last five years even as the city’s population and costs have risen by 8 percent:

“The main point here is that we have cut to the point we will need to reduce services if further reductions are required,” Garza said. “We are trying not to cut programs or services if we can help it.”